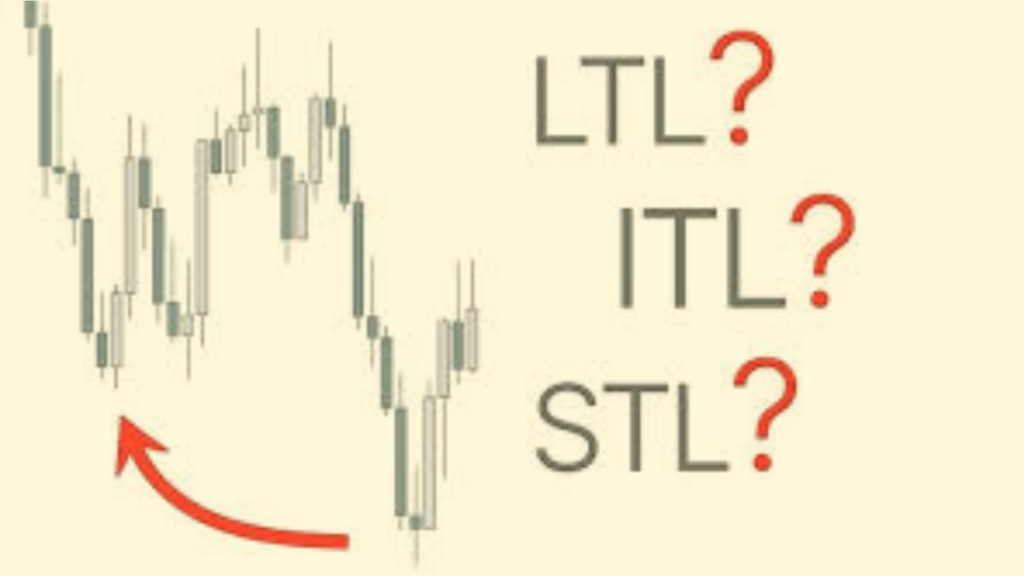

Mastering Market Trends: Understanding ICT STL, ITL & LTL – Advance Market Structure

To be successful in trading, it’s crucial to understand market structure. This guide will help you learn about ICT Short Term Lows (STL), Intermediate Term Lows (ITL), and Long Term Lows (LTL) – key concepts in advanced market structure. For a detailed exploration, you can check out our ICT STL ITL & LTL – Advance Market Structure PDF at fxmarkethours.com. You can also find valuable insights in our ICT STL ITL & LTL – Advance Market Structure book.

What Are ICT STL, ITL, and LTL?

1. ICT Short Term Low (STL):

- Definition: An STL is a low point in the market that appears within a three-candle pattern.

- How to Identify: The low of the middle candle (2nd candle) must be lower than the lows of the two surrounding candles (1st and 3rd).

2. ICT Intermediate Term Low (ITL):

- Definition: An ITL is a deeper low than the surrounding short-term lows.

- How to Identify: It is lower than the short-term lows directly before and after it, making it a more significant dip.

3. ICT Long Term Low (LTL):

- Definition: An LTL is a major low that forms on higher time frames.

- How to Identify: It is lower than the intermediate term lows around it and often occurs after a price reaction at a higher time frame PD Array.

Why STL, ITL, and LTL Matter

- Finding Key Turning Points: Recognizing these lows helps traders spot important market reversals.

- Understanding Market Structure: They show the hierarchy of price lows and help identify support and resistance levels.

The Role of PD Array in LTL

- Higher Time Frame Insights: The PD Array highlights significant price levels on higher time frames.

- Support and Reversal Points: An LTL at a PD Array suggests strong support or a potential change in market direction.

Using STL, ITL, and LTL in Trading

- Setting Entry and Exit Points: These lows help traders make informed decisions on when to buy or sell.

- Confirming Market Trends: Understanding these lows can confirm trends and identify reversal points.

For more in-depth information, check out our ICT STL ITL & LTL – Advance Market Structure trading guide available at fxmarkethours.com.