The forex market operates around the clock, giving traders the flexibility to buy and sell currencies at virtually any time during the week. However, not all hours are created equal. In this comprehensive guide, we’ll explore Forex Market Hours, how they work, and why understanding session timings and overlaps can significantly impact your trading success.

Whether you’re a new trader or a seasoned pro, mastering the basics of forex market hours will help you take advantage of the best trading times and avoid periods of low liquidity.

Understanding Forex Market Structure: Open 24 Hours, 5 Days a Week

The forex market is unique compared to stock exchanges like the NYSE or London Stock Exchange. Instead of operating within a limited timeframe each day, forex trading takes place 24 hours a day, 5 days a week—from Monday morning in Sydney until Friday evening in New York. This is made possible due to the global network of banks, financial institutions, and brokers located in different time zones.

However, while the market is technically always open, trading volume and volatility vary throughout the day. Understanding these fluctuations will help you determine the best time to trade forex and maximize your potential profits.

The Four Major Forex Trading Sessions

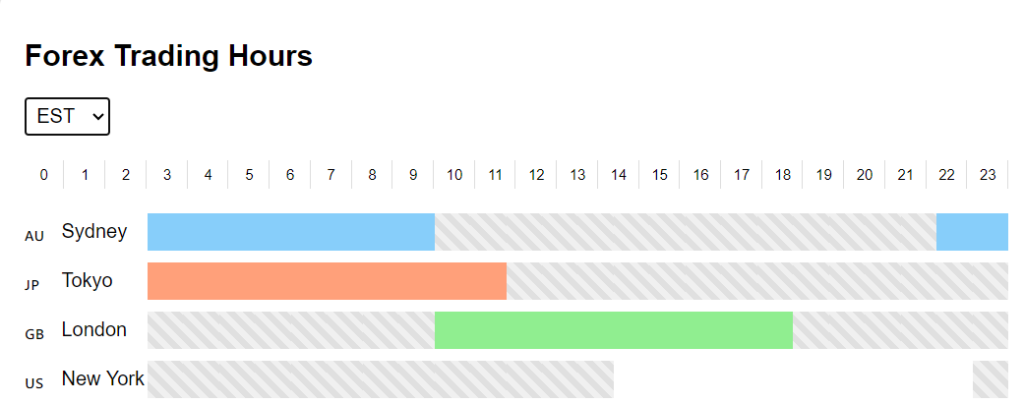

Forex trading is divided into four key trading sessions based on the financial hubs where market activity is concentrated. Each session has its own characteristics, impacting volatility, liquidity, and price movements.

Use the Forex Market Time Conversion Tool to find information about FX market hours according to your local time zone.

Sydney Session (Opens the Week)

- Session Hours: 10 PM to 7 AM UTC

- Main Activity: The Sydney session kicks off the trading week on Monday morning (Sunday evening in certain time zones). While it is the least volatile of the sessions, it sets the tone for the Asian markets.

- Volatility and Liquidity: Trading volume is relatively lower, but it’s ideal for traders who prefer a less volatile market with fewer price swings.

Tokyo Session (Asian Market)

- Session Hours: 12 AM to 9 AM UTC

- Main Activity: The Tokyo session, often referred to as the Asian session, is characterized by moderate volatility. This session typically sees activity in yen pairs, like USD/JPY and EUR/JPY.

- Volatility and Liquidity: While still less volatile than the London or New York sessions, liquidity begins to pick up, especially towards the middle of the session.

London Session (The Largest Market)

- Session Hours: 8 AM to 5 PM UTC

- Main Activity: The London session is the largest and most liquid of all the forex sessions. During this time, you’ll see the most significant price movements, especially in pairs involving the Euro, British Pound, and Swiss Franc.

- Volatility and Liquidity: High volatility and liquidity make this the most active session, with large institutions and banks driving the bulk of the market’s movement.

New York Session (Closes the Week)

- Session Hours: 1 PM to 10 PM UTC

- Main Activity: The New York session is second only to the London session in terms of trading volume. Major currency pairs like EUR/USD, GBP/USD, and USD/JPY experience high volatility, especially during the London-New York overlap.

- Volatility and Liquidity: This session closes the trading week on Friday, and you’ll often see big price moves driven by economic news from the US.

Overlapping Forex Sessions: The Best Times to Trade

One of the unique aspects of forex trading is the overlap between sessions, where two markets are open simultaneously. These overlaps provide the most significant opportunities for traders because of the higher liquidity and volatility they generate.

London-New York Overlap: The Most Profitable Period

- Time: 1 PM to 5 PM UTC

- Why It Matters: When the London and New York sessions overlap, the forex market experiences its highest volatility. This overlap is considered the most profitable time to trade because the high trading volume results in larger price swings and more trading opportunities. Pairs like EUR/USD and GBP/USD tend to move the most during this time.

Tokyo-London Overlap: Less Volatile but Still Significant

- Time: 8 AM to 9 AM UTC

- Why It Matters: The Tokyo-London overlap is shorter and less volatile but can still offer opportunities, especially for traders focusing on yen pairs.

Maximizing Your Strategy

Traders aiming to capitalize on volatility should focus on trading during these overlapping sessions, particularly the London-New York overlap. This is where the market’s liquidity is at its peak, making it ideal for strategies like quick scalping (ICT OTE) or day trading.

Daylight Saving Time and Its Impact on Forex Market Hours

One thing that often confuses traders—especially beginners—is the impact of daylight saving time (DST) on forex market hours. The sessions shift in regions like Europe and North America when DST starts and ends, which affects session times in UTC and GMT.

For example:

- When the US enters daylight saving in March, the New York session starts one hour earlier in UTC time. In the fall, when DST ends, the session shifts back by one hour.

- Similarly, Europe’s London session adjusts in the spring and fall.

Example:

- Before DST (Winter): New York session is 1 PM to 10 PM UTC.

- After DST (Summer): New York session is 12 PM to 9 PM UTC.

Tip: Always check a reliable forex market hours clock or converter when DST changes to avoid trading at the wrong times.

Common Questions About Forex Market Hours

What Time Does the Forex Market Open on Sunday?

The first session to open is the Sydney session, which starts on Monday morning in Sydney but corresponds to Sunday evening in most parts of the world. This session opens at 10 PM UTC.

What Time Does the Forex Market Close on Friday?

The market closes with the New York session, which ends at 10 PM UTC on Friday evening.

Do Forex Market Hours Change with Daylight Saving Time?

Yes, as we discussed earlier, daylight saving affects session times, particularly in the New York and London markets. Always adjust your trading schedule according to the new session times when DST kicks in.

Best Times to Trade Forex Based on Session Activity

If you’re looking for the most profitable trading times, you’ll want to focus on periods of high volatility and liquidity also known as ICT Kill Zones.

- During session overlaps, particularly the London-New York overlap (1 PM to 5 PM UTC), which offers the highest market activity and price movements.

- Avoid periods of low liquidity, such as the closing of the New York session on Friday, as this is when market activity slows down.

Always stay aware of daylight saving time changes to ensure you’re trading at the most profitable times. By timing your trades to coincide with these key market hours, you can increase your chances of success in the dynamic forex market.

Final Tip: Use a forex market hours clock or converter to track active sessions in your local time zone, especially during periods when daylight saving time is in effect.