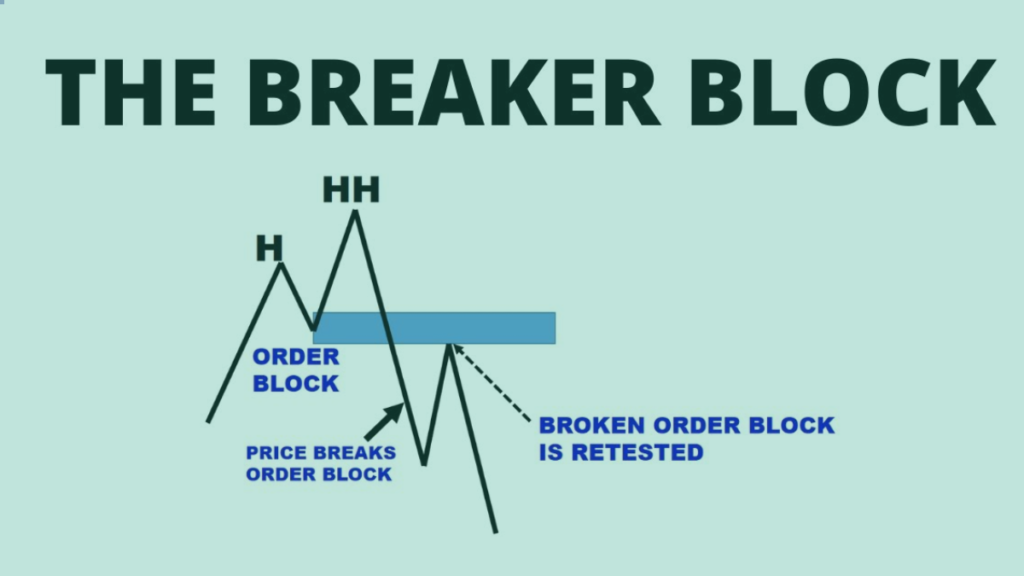

A breaker block is a key concept in trading, especially in strategies like ICT (Inner Circle Trader). It’s essentially an order block that fails after a significant market event like a liquidity sweep or a change in market direction. When traders set up buy or sell orders around these blocks, market makers sometimes push the price the other way, causing the order block to fail. This failed order block is what we call a breaker block.

Types of Breaker Blocks

There are two main types of breaker blocks:

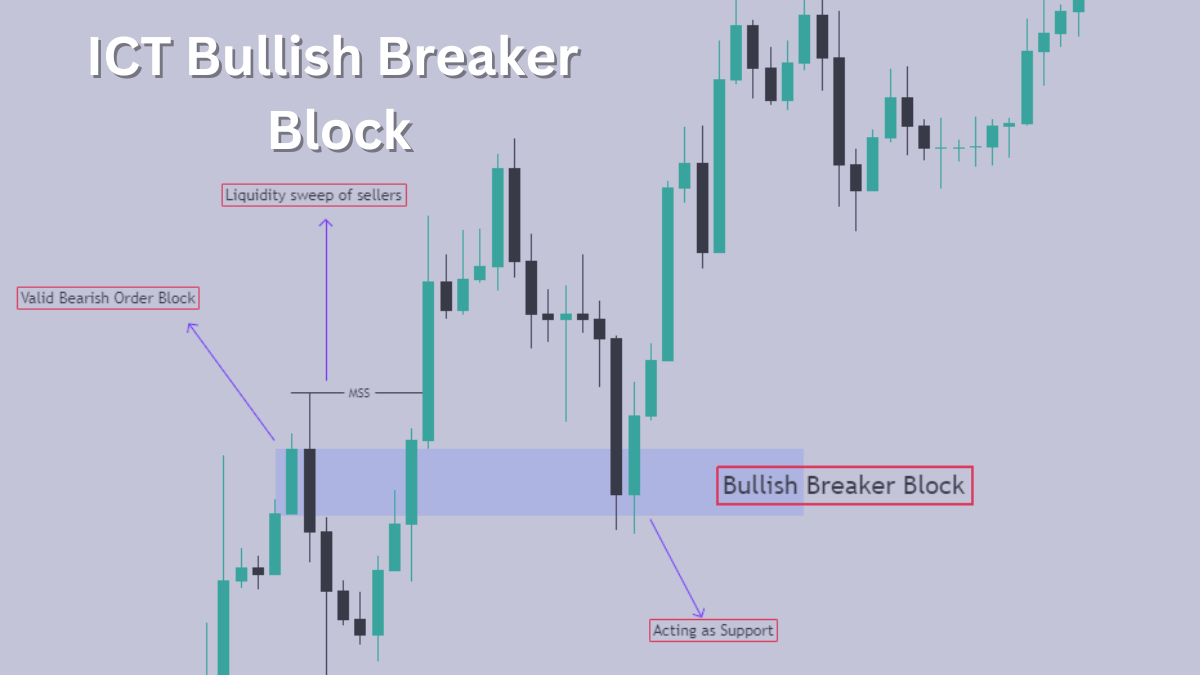

- Bullish Breaker Block: This happens when a bearish order block (where prices were expected to drop) fails, and the price moves higher instead. The broken bearish order block now acts as support, pushing prices even higher.

- Bearish Breaker Block: This occurs when a bullish order block (where prices were expected to rise) fails, and the price moves lower instead. The broken bullish order block now acts as resistance, pushing prices even lower.

How to Identify a Valid Breaker Block

To spot a valid breaker block, look for these signs:

- A clear order block (bullish or bearish).

- The price breaking through the order block (above for bullish, below for bearish).

- A liquidity sweep (a sudden price movement that triggers stop losses).

- A shift in market structure (the overall direction of the market changes).

How to Trade ICT Breaker Block

Using the ICT breaker block strategy can help you trade more effectively:

- Bullish Breaker Block Trading Strategy: In a market that’s trending upward, look for a bearish order block that gets broken when the price moves higher. Once the price closes above this block, it turns into a bullish breaker block. Wait for the price to come back and test this area, then enter a buy trade. Set your stop loss 10-20 pips below the bullish breaker block to manage risk.

- Bearish Breaker Block Trading Strategy: In a market that’s trending downward, watch for a bullish order block that fails when the price moves lower. Once the price closes below this block, it turns into a bearish breaker block. Wait for the price to retest this area, then enter a sell trade. Set your stop loss 10-20 pips above the bearish breaker block.

Final Thoughts on Breaker Block Trading

While using the breaker block trading strategy can be powerful, remember that no strategy is perfect. Always use stop losses to protect your trades and never risk more than you can afford to lose. By mastering how to trade ICT breaker blocks, you can improve your trading results and better navigate the markets.