Price Action Breakout Strategies

Price action breakout strategies are popular among traders because they can lead to significant market movements. These strategies are based on observing price movements and identifying when a breakout is likely to occur. When prices break out from a certain level, they often move strongly in one direction, either up or down. Understanding and using these strategies can help traders make better decisions and potentially increase their profits.

This guide will explain the basics of price action breakout strategies, introduce different types of breakout strategies, and offer tips for trading them effectively.

What Are Price Action Breakout Strategies?

At its core, a price action breakout strategy involves watching how prices move and identifying key levels where the price might break out. A breakout happens when the price moves above a resistance level or below a support level. These breakouts often lead to strong price movements, making them valuable opportunities for traders.

Breakouts can happen in two main market conditions:

- Trending Markets: In a trending market, breakouts often continue the trend. For example, in an uptrend, a breakout above a resistance level can signal that the price will keep rising.

- Counter-Trend Moves: Sometimes, breakouts occur in the opposite direction of the current trend. These are called counter-trend breakouts and can signal a reversal in the market’s direction.

Types of Breakout Strategies

There are several types of breakout strategies that traders use. Understanding these can help you choose the best approach for your trading style.

1. Trend Continuation Breakout Strategy

A trend continuation breakout strategy is used when the market is already trending in a certain direction. Traders look for a breakout in the same direction as the trend. For example, if the market is in an uptrend, a trader would watch for a breakout above a resistance level to signal that the uptrend will continue.

Example: Imagine the market has been trending upwards for several days. You notice that the price has formed a pattern called a “bullish fakey,” which often indicates a potential breakout. As soon as the price breaks above the high of this pattern, it signals that the uptrend might continue, and you decide to enter a buy trade.

2. Inside Bar Breakout Strategy

An inside bar breakout strategy focuses on a pattern called the “inside bar.” An inside bar is a smaller price range that forms within the previous bar’s range. This pattern suggests that the market is consolidating before making a move. When the price breaks out of this range, it often signals the start of a new trend.

Example: On a daily chart, you might spot an inside bar forming after a strong trend. This consolidation suggests that the market is taking a breather before deciding its next move. If the price breaks out above the inside bar, it signals a continuation of the previous trend, and you might enter a trade in that direction.

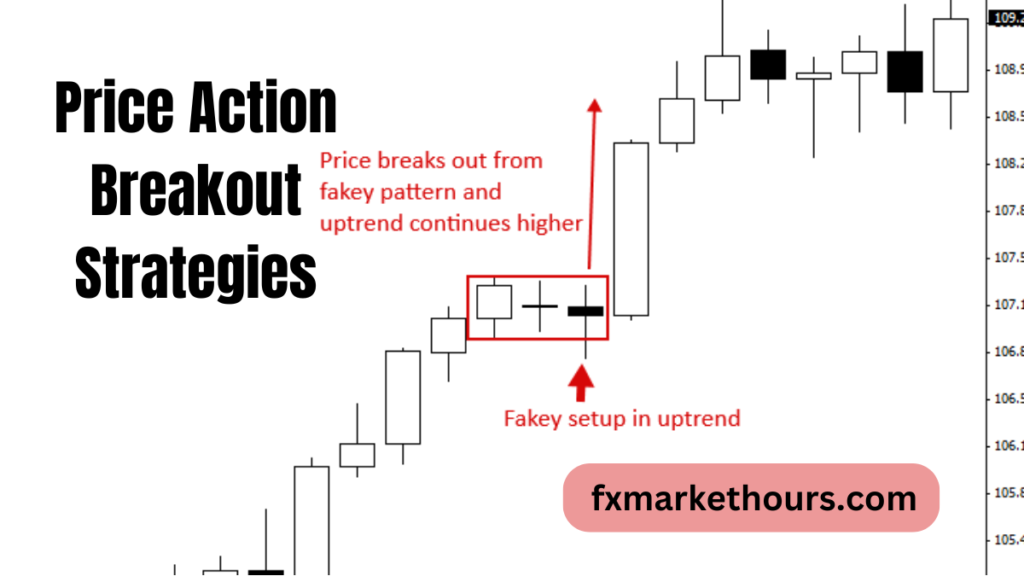

3. Fakey Breakout Strategy

The fakey breakout strategy involves a false breakout from an inside bar pattern. After the false breakout, the price reverses direction and breaks out on the other side. This strategy can be powerful because it often catches traders off guard, leading to strong moves in the opposite direction.

Example: Suppose you see a false breakout to the downside from an inside bar pattern, followed by a strong reversal to the upside. This reversal forms a “fakey” pattern, and when the price breaks out above the mother bar of the inside bar, it signals a strong upward move. You might enter a buy trade, expecting the price to continue higher.

Trading Breakouts from Key Levels

Another effective approach is trading breakouts from key chart levels like support or resistance. These levels are where the price has previously reversed or stalled, making them important areas to watch for potential breakouts.

Example: Imagine the price is approaching a key resistance level that it has tested multiple times. If the price finally breaks above this level, it could signal a strong move upward. This is known as a “breakout-reversal play,” where the breakout leads to a reversal of the previous trend.

Tips for Trading Price Action Breakout Strategies

Here are some practical tips to help you trade price action breakout strategies effectively:

- Use Stop Entry Orders: When trading breakouts, it’s common to use stop entry orders. This means placing a buy-stop order above the breakout level or a sell-stop order below it. When the price hits this level, your order is triggered, bringing you into the trade. This approach allows you to enter the market with momentum on your side.

- Watch for Confluence: Look for other signals that support the breakout. For example, if the breakout happens at a key chart level or is confirmed by a strong trend, it adds more confidence to the trade.

- Manage Risk: Breakouts can be powerful, but they can also fail. It’s important to manage your risk by using stop-loss orders. This way, if the breakout fails, your losses are limited.

Conclusion

Price action breakout strategies are a key tool in a trader’s arsenal. By understanding the different types of breakout strategies and knowing how to trade them, you can take advantage of strong market moves. Whether you’re trading in a trending market or looking for a reversal at key levels, these strategies offer a simple yet effective way to make informed trading decisions.

For more in-depth information and examples, you can download our Price Action Breakout Strategies PDF. This resource provides detailed explanations, chart examples, and additional tips to help you master the best breakout strategies.

By mastering these strategies and applying them with discipline, you can improve your trading performance and increase your chances of success in the markets.