Japanese candlestick patterns are popular tools used by traders to understand market movements. They provide a visual way to see how prices change over a certain period, like a day or an hour. The patterns are simple yet powerful and can help traders predict whether the market will go up or down.

In this introduction to Japanese candlestick patterns, we’ll cover the basics of what these patterns are, how they work, and why they are so important. If you’re new to trading or want to learn more, this guide will help you get started. You can also find more detailed information in resources like an “Introduction to Japanese Candlestick Patterns PDF” or the “Introduction to Japanese Candlestick Patterns book.”

What is a Japanese Candlestick?

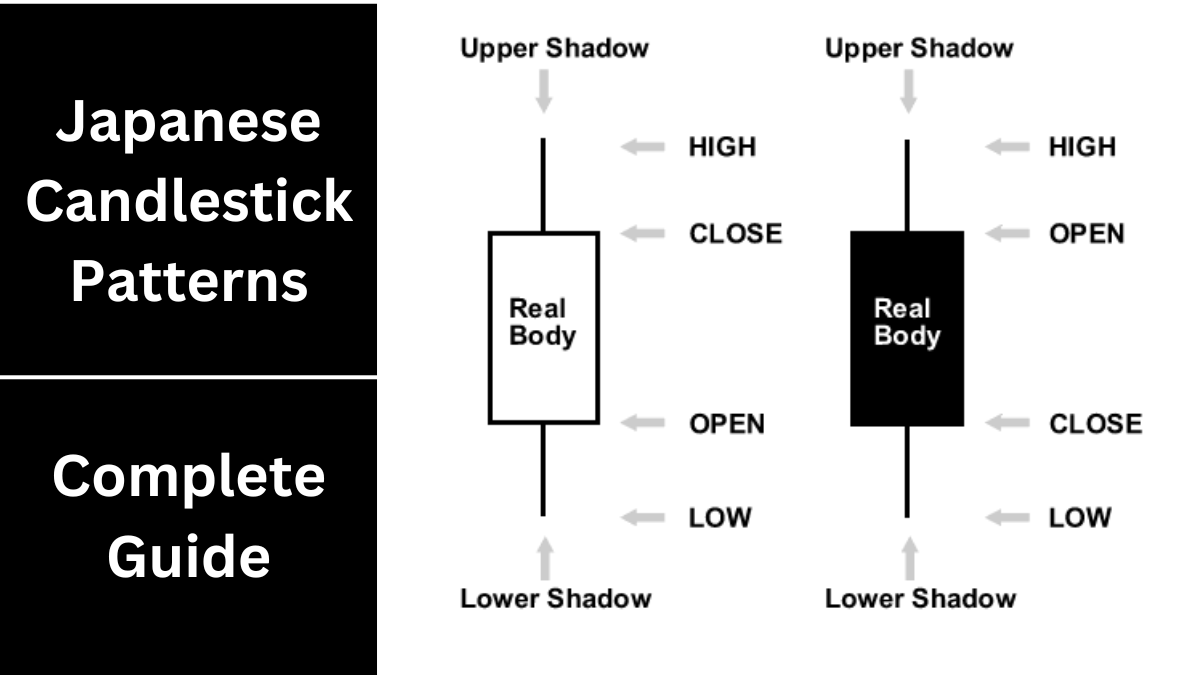

A Japanese candlestick is a type of chart used in trading to show the price movements of an asset over a specific time. Each candlestick represents one period of time, such as a day, an hour, or even a minute. The candlestick shows four key pieces of information: the opening price, the highest price, the lowest price, and the closing price for that period.

The main part of the candlestick is called the real body. This part shows the difference between the opening and closing prices. If the closing price is higher than the opening price, the real body is usually colored green or white. This is called a bullish candle because it shows that the price went up. If the closing price is lower than the opening price, the real body is colored red or black. This is called a bearish candle because it shows that the price went down.

Above and below the real body are thin lines called shadows, wicks, or tails. These lines show the highest and lowest prices reached during the period. The top of the upper shadow shows the highest price, and the bottom of the lower shadow shows the lowest price.

History of Japanese Candlestick Patterns

Japanese candlestick patterns have a long history, dating back to the 18th century. They were first used by Japanese rice traders to track prices and predict future movements. The method was developed by a trader named Munehisa Homma, who is often credited with creating the first candlestick charts. Over time, this technique became widely popular among traders, and it remains a key part of trading strategies today. If you’re interested in learning more, you might explore resources on “Japanese Candlestick History.”

How to Read Japanese Candlestick Patterns

Reading Japanese candlestick patterns is like learning a new language. Once you understand the basics, you can start to see patterns and predict market movements.

Here are a few common candlestick patterns:

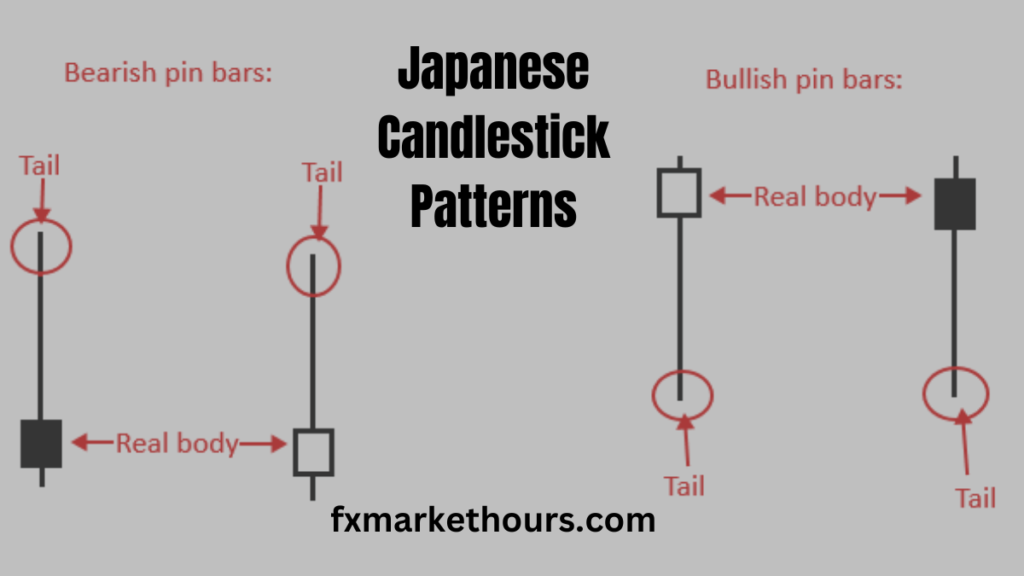

- Pin Bar: This pattern has a small real body and a long shadow on one side. It shows that the price is rejected at a certain level and may reverse direction. Traders often use the pin bar to identify potential reversals in the market.

- Inside Bar: An inside bar pattern occurs when a small candlestick forms within the range of the previous candlestick. This pattern often indicates indecision in the market and can signal a breakout in either direction.

- Fakey Pattern: The fakey pattern is a more complex pattern that shows a false breakout. This happens when the price briefly breaks out of range but then reverses and moves in the opposite direction. Traders use this pattern to identify false moves and potential opportunities.

These are just a few examples of the many patterns that traders use. Learning the names and characteristics of these patterns is an essential part of mastering Japanese candlestick trading. There are many resources available, including the “Introduction to Japanese Candlestick Patterns book,” which can provide a deeper understanding of these patterns.

The Importance of Japanese Candlestick Patterns in Trading

Japanese candlestick patterns are important because they provide a clear and easy-to-read way to understand market sentiment. The color and shape of the candlesticks give traders a quick view of whether the market is moving up or down.

One of the biggest advantages of using candlestick patterns is their simplicity. Unlike other chart types, like bar charts or line charts, candlestick charts are easy to read at a glance. The colored bodies and shadows make it easy to see what’s happening in the market.

Another advantage is that these patterns can be used in any market and in any time frame. Whether you’re trading stocks, forex, or cryptocurrencies, and whether you’re looking at a daily chart or a 5-minute chart, candlestick patterns can help you make better trading decisions.

Learning Japanese Candlestick Patterns

Learning Japanese candlestick patterns takes time and practice. It’s important to start with the basics and gradually build your knowledge. Begin by learning a few key patterns, such as the pin bar, inside bar, and fakey pattern. As you become more comfortable, you can start exploring more advanced patterns.

There are many resources available to help you learn. You can find an “Introduction to Japanese Candlestick Patterns PDF” online that provides a quick overview. Books like the “Introduction to Japanese Candlestick Patterns book” offer more in-depth explanations and examples.

Another effective way to learn is by watching the markets and practicing what you’ve learned. Spend time studying charts and identifying patterns in real time. Over time, you’ll start to see these patterns more clearly and understand how they can be used to make trading decisions.

Conclusion

Japanese candlestick patterns are a powerful tool for traders. They provide a simple and effective way to read market movements and predict future trends. Whether you’re a beginner or an experienced trader, understanding these patterns is essential for success in the markets.

By starting with the basics and gradually building your knowledge, you can become proficient in reading and using Japanese candlestick patterns. With practice, you’ll be able to spot opportunities and make better trading decisions. For more detailed information, consider exploring resources like an “Introduction to Japanese Candlestick Patterns PDF” or the “Introduction to Japanese Candlestick Patterns book.”