In this post, we’ll explore ICT Weekly Range Profiles, which are essential concepts for traders looking to predict price movements during a trading week. We will define these profiles, explain how to identify them, and show you how to use them in real trading situations. By thoroughly understanding these concepts and applying them in the market, you’ll develop the skills needed to trade ICT Weekly Range Profiles like a pro.

What Are ICT Weekly Range Profiles?

ICT Weekly Range Profiles are frameworks that describe typical patterns of price behavior throughout a trading week. These profiles help traders anticipate possible market movements by understanding the patterns that prices usually follow within the week. However, it’s important to remember that these profiles are not fixed predictions; they’re more like tools to help you understand market tendencies and make informed decisions.

Each ICT Weekly Range Profile has unique characteristics that can give traders clues about what might happen next in the market. Let’s go through some of the most common ICT Weekly Range Profiles and how you can use them in your trading.

(I) Classic Tuesday Low of the Week (Bullish Profile)

In a bullish market, the price often manipulates on Monday and stays above a higher timeframe discount array. On Tuesday, the price may drop into this discount area to form the low of the week.

How to Anticipate: To anticipate this, you need to be aware of the higher timeframe discount array. If the price doesn’t drop into this area on Monday, it’s likely that Tuesday will see the market drive lower, marking the weekly low during the London or New York session.

(II) Classic Tuesday High of the Week (Bearish Profile)

In a bearish market, the price may manipulate on Monday and stay below a higher timeframe premium array. On Tuesday, it might rise into this premium area to form the high of the week.

How to Anticipate: You need to understand the higher timeframe premium array to anticipate this movement. If the price doesn’t rise into this area on Monday, it’s likely that Tuesday will see the market drive higher, marking the weekly high during the London or New York session.

(III) Wednesday Low of the Week (Bullish Profile)

In this scenario, the price may manipulate on Monday and Tuesday, hovering above a higher timeframe discount array. On Wednesday, the price might drop into this discount area to form the low of the week.

How to Anticipate: To anticipate this, you should be aware of the higher timeframe discount array. If the price doesn’t drop into this area on Monday and Tuesday, it’s likely that Wednesday will see the market drive lower, marking the weekly low during the London or New York session.

(IV) Wednesday High of the Week (Bearish Profile)

In this case, the price may manipulate on Monday and Tuesday, staying below a higher timeframe premium array. On Wednesday, the price could rise into this premium area to form the high of the week.

How to Anticipate: Understanding the higher timeframe premium array is crucial. If the price doesn’t rise into this area on Monday and Tuesday, it’s likely that Wednesday will see the market drive higher, marking the weekly high during the London or New York session.

(V) Consolidation Thursday Bullish Reversal

In a bullish market, the price may consolidate from Monday through Wednesday, then drop to a new low and reject it, leading to a market reversal.

How to Anticipate: You must know the higher timeframe discount array. If the price doesn’t drop into this area, Thursday may see a drive lower, possibly triggered by major news or interest rate releases around 02:00 PM (New York local time).

(VI) Consolidation Thursday Bearish Reversal

In a bearish market, the price might consolidate from Monday through Wednesday, then rise to a new high and reject it, leading to a market reversal.

How to Anticipate: Understanding the higher timeframe premium array is essential. If the price doesn’t rise into this area, Thursday could see a drive higher, possibly influenced by major news or interest rate releases around 02:00 PM (New York local time).

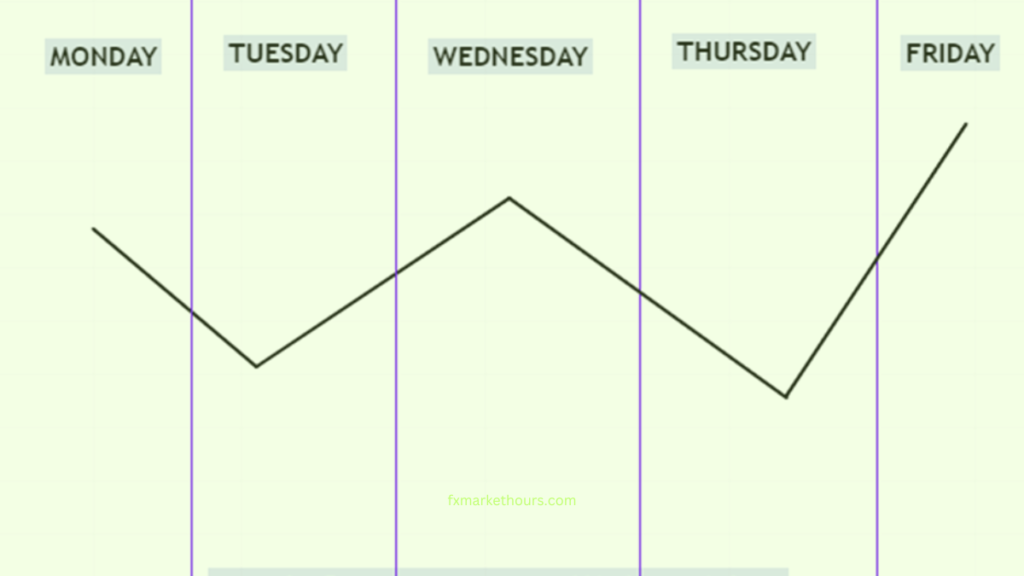

(VII) Consolidation Midweek Rally (Bullish Profile)

In a bullish market, if the price consolidates from Monday through Wednesday and then breaks into a new high, it may expand higher into Friday.

How to Anticipate: If the price has recently rallied from a discount array and is now pausing without any bearish reversal signals, this indicates that the price is likely to expand higher towards the premium array.

(VIII) Consolidation Midweek Decline (Bearish Profile)

In a bearish market, if the price consolidates from Monday through Wednesday and then drops to a new low, it may continue to decline into Friday.

How to Anticipate: If the price has recently dropped from a premium array and is now pausing without any bullish reversal signals, this suggests that the price is likely to continue declining towards the discount array.

(IX) Seek and Destroy Bullish Friday (Neutral-Low Probability Profile)

Sometimes, the price consolidates from Monday through Thursday, running shallow stops both above and below the intra-week high. Then, on Friday, the price might break above the intra-week high and expand higher.

How to Anticipate: This profile often occurs when the market is waiting for major announcements like interest rates or Non-Farm Payroll. It’s more common in the summer months of July and August. It’s usually better to avoid trading in these conditions due to the high level of uncertainty.

(X) Seek and Destroy Bearish Friday (Neutral-Low Probability Profile)

In this scenario, the price may consolidate from Monday through Thursday, running shallow stops both above and below the intra-week high. On Friday, the price might drop below the intra-week low and expand lower.

How to Anticipate: Similar to the bullish version, this profile often forms when the market is awaiting major announcements. It’s more common in July and August, and it’s usually better to avoid trading during these times due to the increased unpredictability.

(XI) Wednesday Weekly Bullish Reversal

In a bullish market, if the price consolidates from Monday through Tuesday and then drives lower into a higher timeframe discount array on Wednesday, it may induce sell stops and then strongly reverse.

How to Anticipate: When the market is at a long-term or intermediate-term low, this reversal is likely to happen as institutional buying pairs with sell-side liquidity (a raid on sell stops).

(XII) Wednesday Weekly Bearish Reversal

In a bearish market, if the price consolidates from Monday through Tuesday and then drives higher into a higher timeframe premium array on Wednesday, it may induce buy stops and then strongly reverse.

How to Anticipate: When the market is at a long-term or intermediate-term high, this reversal often occurs as institutional selling pairs with buy-side liquidity (a raid on buy stops).