In this guide, we’ll cover the ICT Weekly Range Expansion Model, a short-term trading strategy based on the ICT Charter Content. By understanding and practicing this model, you can become proficient at trading range expansions during the week.

What is the ICT Weekly Range Expansion Model?

The ICT Weekly Range Expansion Model is designed to help traders during weeks of price expansion, whether bullish or bearish. It uses three key ICT PD Arrays:

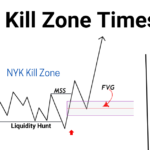

- Fair Value Gap

- Old Low/High

- Liquidity Pool

The model follows three steps:

- STAGE (Weekly Direction)

- SETUP (Range Expansion)

- PATTERN (Execution)

STAGE involves determining the weekly direction by looking at the weekly chart. Identify if the price will target liquidity or fill the Fair Value Gap.

SETUP is about recognizing range expansion and preparing for the trade based on the PD Arrays.

PATTERN is about executing the trade using the information from the PD Arrays.

How to Trade Bullish Week Range Expansion

- Determine Weekly Bias: Check if the weekly chart shows a bullish trend by seeing if it has taken sell-side liquidity or is in the Discount PD Array. It should aim for buy-side liquidity or a Premium PD Array. Look for a daily Market Structure Shift to the buy-side for extra confirmation.

- Wait for the New Week Opening: Use either Sunday or Monday’s opening to start, but wait until Monday to execute the trade. Monday often sets the low of the week and starts range expansion.

- Execute the Trade: Buy on Tuesday at the opening of the 04:00 AM (NY local time) candlestick. You can buy at the opening price or slightly below.

- Hold the Trade: Keep the trade open until Thursday New York opening, as range expansion usually happens from Tuesday to Thursday.

- Stop Loss: Set your stop loss 50 pips below your buying price.

How to Trade Bearish Week Range Expansion

- Determine Weekly Bias: Ensure you have a bearish bias by checking if the weekly chart shows buy-side liquidity taken or if it’s in the Premium PD Array. It should target sell-side liquidity or a Discount PD Array. Look for a daily Market Structure Shift to the sell-side for extra confirmation.

- Wait for the New Week Opening: Similar to the bullish strategy, use either Sunday or Monday’s opening but execute the trade on Tuesday. Tuesday often sets the high of the week and starts range expansion.

- Execute the Trade: Sell on Tuesday at the opening of the 04:00 AM (NY local time) candlestick. You can sell at the opening price or slightly above.

- Hold the Trade: Keep the trade open until Thursday New York opening.

- Stop Loss: Set your stop loss 50 pips above your selling price.

Final Thoughts

Your top priority should be preserving your capital. Use stop losses, manage your positions carefully, and never risk more than you can afford to lose. This bearish week range expansion strategy is structured but needs careful analysis and discipline.

If you have any questions or need more details, leave a comment below. Happy trading and stay safe.