If you want to understand ICT Mitigation Blocks in-depth, this guide is for you. We’ll cover everything from how these blocks form, how to identify them, and how to use them in trading with real market examples. By the end of this post, you’ll be able to recognize and trade ICT Mitigation Blocks with confidence. Whether you’re a beginner or an experienced trader, this detailed explanation will help you.

What is an ICT Mitigation Block?

An ICT Mitigation Block is a pattern in trading that signals a potential reversal in the market. It happens when the market fails to make a new high in a bullish trend or a new low in a bearish trend. This failure usually occurs at key points in the market, such as order blocks, breaker blocks, or areas of imbalance. In simpler terms, the market tries to push higher or lower but can’t, and this signals that the trend might be about to change.

The basic idea behind the ICT Mitigation Block is to sell short-term rallies in a bearish market and buy short-term dips in a bullish market. This strategy allows traders to take advantage of these potential reversals.

How to Identify an ICT Mitigation Block?

To trade ICT Mitigation Blocks effectively, it’s important to know how to identify them. These blocks can be divided into two main types: Bearish ICT Mitigation Blocks and Bullish ICT Mitigation Blocks. Let’s break down each one.

1. Bearish ICT Mitigation Block

A Bearish ICT Mitigation Block forms at the end of a bullish trend. Here’s how it works:

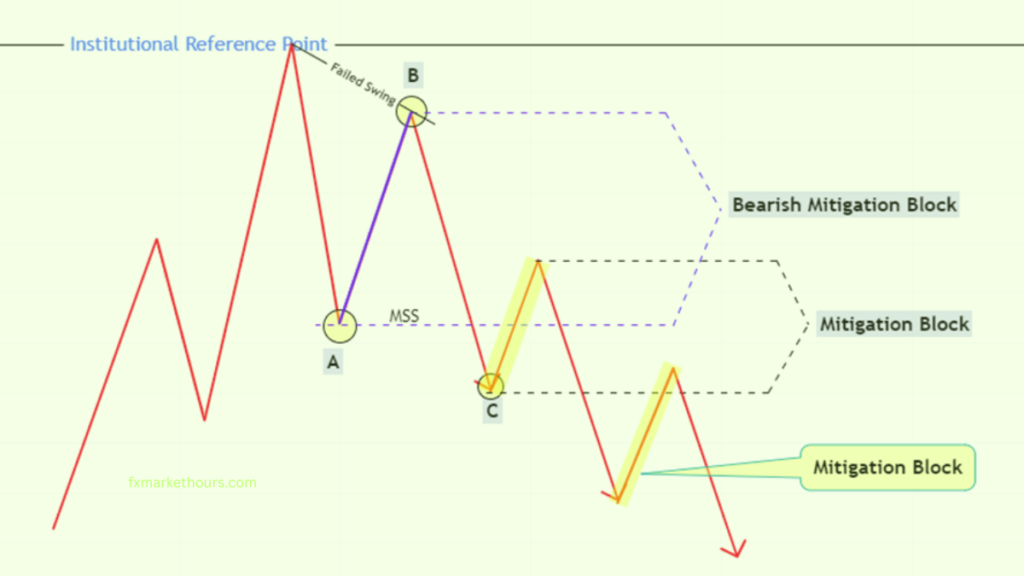

- Formation: The price has been rising, creating higher highs and higher lows. Eventually, the price reaches a strong bearish reference point, such as a bearish order block, breaker block, or a higher timeframe buy-side liquidity area. At this point, instead of continuing to make new higher highs, the price makes a lower high. This is the first sign that the bullish trend might be weakening.

- Market Structure Shift: After making a lower high, the price begins to decline. When the price breaks below the previous higher low, it signals a shift in the market structure from bullish to bearish. This means that the uptrend is likely over, and a downtrend may be starting.

- Failure to Swing Higher: This situation is known as the “failure of price to swing higher.” The area between the broken swing low (labeled as Point A) and the lower swing high (labeled as Point B) becomes the Bearish Mitigation Block. Traders who were buying during the bullish trend may start to sell to minimize their losses when the price returns to this area. Smart traders might look for selling opportunities in this zone because the market bias has turned bearish.

2. Bullish ICT Mitigation Block

A Bullish ICT Mitigation Block forms at the end of a bearish trend. Here’s how it works:

- Formation: The price has been falling, creating lower lows and lower highs. Eventually, the price reaches a strong bullish reference point, such as a bullish order block, breaker block, or a higher timeframe sell-side liquidity area. At this point, instead of continuing to make new lower lows, the price makes a higher low. This is the first sign that the bearish trend might be weakening.

- Market Structure Shift: After making a higher low, the price begins to rise. When the price breaks above the previous lower high, it signals a shift in the market structure from bearish to bullish. This means that the downtrend is likely over, and an uptrend may be starting.

- Failure to Swing Lower: This situation is known as the “failure of price to swing lower.” The area between the broken swing high (labeled as Point A) and the higher swing low (labeled as Point B) becomes the Bullish Mitigation Block. Traders who were selling during the bearish trend may start to buy to minimize their losses when the price returns to this area. Smart traders might look for buying opportunities in this zone because the market bias has turned bullish.

ICT Mitigation Block vs. ICT Breaker Block

It’s important to understand the difference between an ICT Mitigation Block and an ICT Breaker Block. Both are reversal patterns, but they have distinct characteristics:

- ICT Breaker Block: This pattern forms after the market sweeps a high or low and then shifts its structure. In a Breaker Block, you mark the last up or down closed candle as your point of interest.

- ICT Mitigation Block: This pattern forms when the price fails to make a new high in a bullish trend or a new low in a bearish trend, without sweeping a high or low. Instead of marking a single candle, you focus on the short-term price rally or decline as your point of interest.

The key difference is that the ICT Mitigation Block doesn’t involve sweeping a high or low before the structure shift. Instead, it relies on the market’s failure to continue in its current direction.

Example: XAU/USD Mitigation Block

Let’s look at a real market example to better understand how the ICT Mitigation Block works. Below is an example using the XAU/USD (Gold vs. U.S. Dollar) H4 chart:

- Initial Bullish Trend: The price is in a clear uptrend, making higher highs and higher lows. Traders are buying as the price continues to rise.

- Reaching a Bearish Point: The price reaches a bearish institutional reference point, like a bearish order block. At this point, instead of making a new higher high, the price starts to decline, making a lower high.

- Market Structure Shift: After making the lower high, the price breaks below the previous low, indicating a shift in the market structure from bullish to bearish. This break creates the Bearish ICT Mitigation Block.

- Trading Opportunity: The price retraces back to the Bearish Mitigation Block. This is where smart traders will look to sell, taking advantage of the new bearish bias in the market. The result is a high-probability sell setup, as seen in the chart example.

Conclusion

By understanding and applying the concepts explained in this guide, you’ll be better equipped to identify and trade ICT Mitigation Blocks in your trading journey. The key is to recognize when the market fails to continue its current trend and to use that information to anticipate potential reversals.

This ICT Mitigation Block Explained in Depth guide should give you a solid foundation. Whether you’re looking to download an ICT Mitigation Block Explained in Depth pdf or need an ICT Mitigation Block Explained in Depth ppt for presentations, mastering this concept can enhance your trading strategy and improve your market analysis.

With practice, identifying and trading these blocks will become second nature, helping you make more informed trading decisions.