The ICT Fair Value Gap trading strategy is about finding and using the difference between what an asset is currently priced at and what it should be priced at—this difference is called the “Fair Value Gap” (FVG).

What is ICT Fair Value Gap in Trading?

ICT Fair Value Gap Explained in Forex and Trading:

The ICT Fair Value Gap is the gap between an asset’s current market price and its “fair” price. For example, if the current price of Gold (XAU/USD) is 1845, but you and other market experts believe it should be 1850, there’s a fair value gap of 5 USD. This gap suggests that Gold is undervalued and might move up to its fair value, offering a potential trade opportunity.

This concept applies to various markets like forex, indices, metals, stocks, crypto, and commodities. Fair Value Gaps happen due to reasons like market manipulation or extreme buying or selling pressures.

How to Identify ICT Fair Value Gaps?

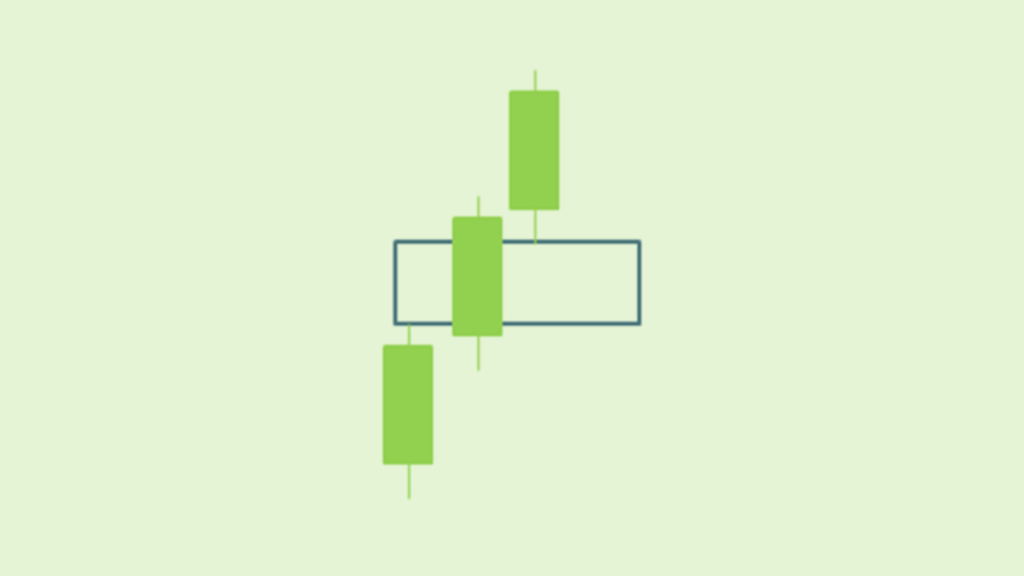

You can spot a Fair Value Gap by looking for a specific three-candle pattern on your trading chart:

- Middle Candle: Look for a candle in the middle that has a large body and small wicks.

- First and Third Candles: The candles before and after this middle candle should have small bodies that don’t completely overlap the middle candle’s body.

- The Gap: The space (gap) between the low of the first candle and the high of the third candle is your Fair Value Gap.

There are two types of Fair Value Gaps:

- Bullish Fair Value Gap: Happens during a rising market (bullish trend) and can act as a support level, meaning the price might bounce up from this level.

- Bearish Fair Value Gap: Happens during a falling market (bearish trend) and can act as a resistance level, meaning the price might drop after reaching this level.

How to Trade Using ICT Fair Value Gap?

Here’s a step-by-step guide to trading with Fair Value Gaps:

- Identify the Market Trend: Determine if the market is going up (bullish) or down (bearish).

- Find the Large Candle: Look for a strong candle that shows a big price movement.

- Check the Nearby Candles: Make sure the candles before and after this large candle create a gap with it.

- Mark the Fair Value Gap: Draw a line to highlight the gap between the first and third candles.

- Make the Trade: Wait for the market to move back and test the Fair Value Gap, then enter a trade. For example, in a bullish trend, you might buy after the market tests and bounces from the gap.

Final Thoughts

Remember, not every Fair Value Gap is a good trading opportunity. Use them together with other strategies like support and resistance levels or demand and supply zones to improve your chances. Always trade with a stop-loss to manage your risk because no trading strategy is perfect.

For more details, you can check out my ICT Trading Strategies PDF eBook at fxmarkethours.com.