To trade successfully using the ICT strategy, understanding the daily bias is crucial. The ICT daily bias tells you if the market is expected to go up (bullish) or down (bearish) on any given day. This guide explains ICT Daily Bias in depth, making it easier for you to trade like a pro.

What is ICT Daily Bias?

ICT Daily Bias is the expected direction of price movement for the day. Predicting this correctly is key to making successful trades. This guide, “ICT Daily Bias Explained in Depth,” is available for free download as a PDF and a PPT.

How to Identify ICT Daily Bias

To find the correct daily bias, consider these key elements:

- Daily Timeframe Order Flow: This is the main way to identify the ICT daily bias. Big traders, like banks, use the daily chart to make their moves. If the market is moving up (bullish), your daily bias should be up. If it’s moving down (bearish), your daily bias should be down.

- Imbalance Rebalancing: Price often moves to fix an imbalance in the market. If you see an imbalance, the price might go up or down to correct it.

- Draw on Liquidity: Prices also move to target liquidity, like old highs or lows. Knowing where this liquidity is helps predict where the price might go next.

Understanding Order Flow to Set Daily Bias

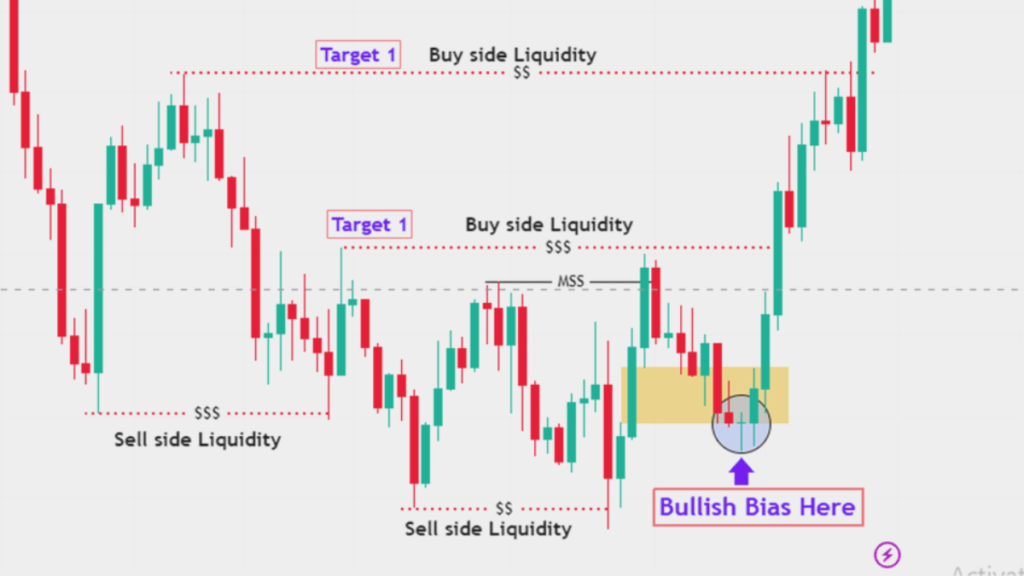

- Bullish Order Flow: If prices are making higher highs and higher lows, the market is likely going up. This is a bullish order flow, and your daily bias should be bullish, meaning you should look for buying opportunities.

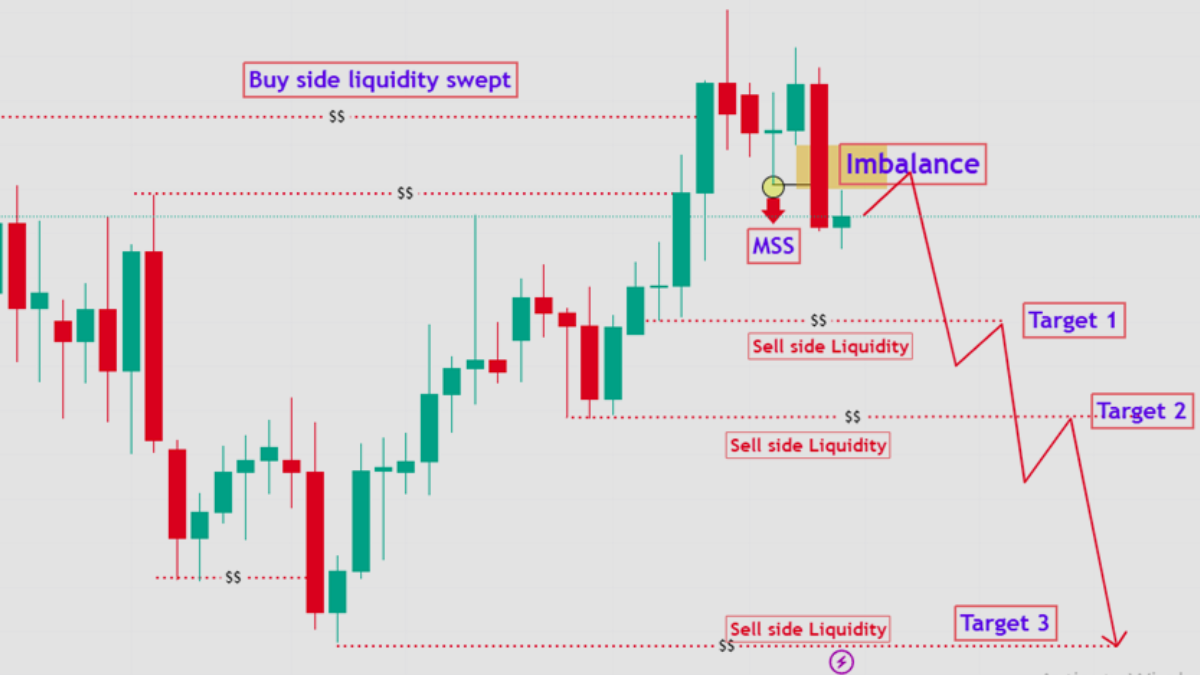

- Bearish Order Flow: If prices are making lower lows and lower highs, the market is likely going down. This is a bearish order flow, and your daily bias should be bearish, meaning you should look for selling opportunities.

How to Trade Using ICT Daily Bias

- Bullish Daily Bias: Once you see a bullish daily bias, identify points of interest like order blocks. Then, switch to a lower timeframe (15 or 30 minutes) and wait for the price to confirm your bias before you buy.

- Bearish Daily Bias: With a bearish daily bias, identify key areas like fair value gaps. Then, move to a lower timeframe to wait for confirmation before you sell.

Download the “ICT Daily Bias Explained in Depth” guide for free as a PDF or PPT to get a more detailed explanation and start improving your trading today.