What is a False Breakout?

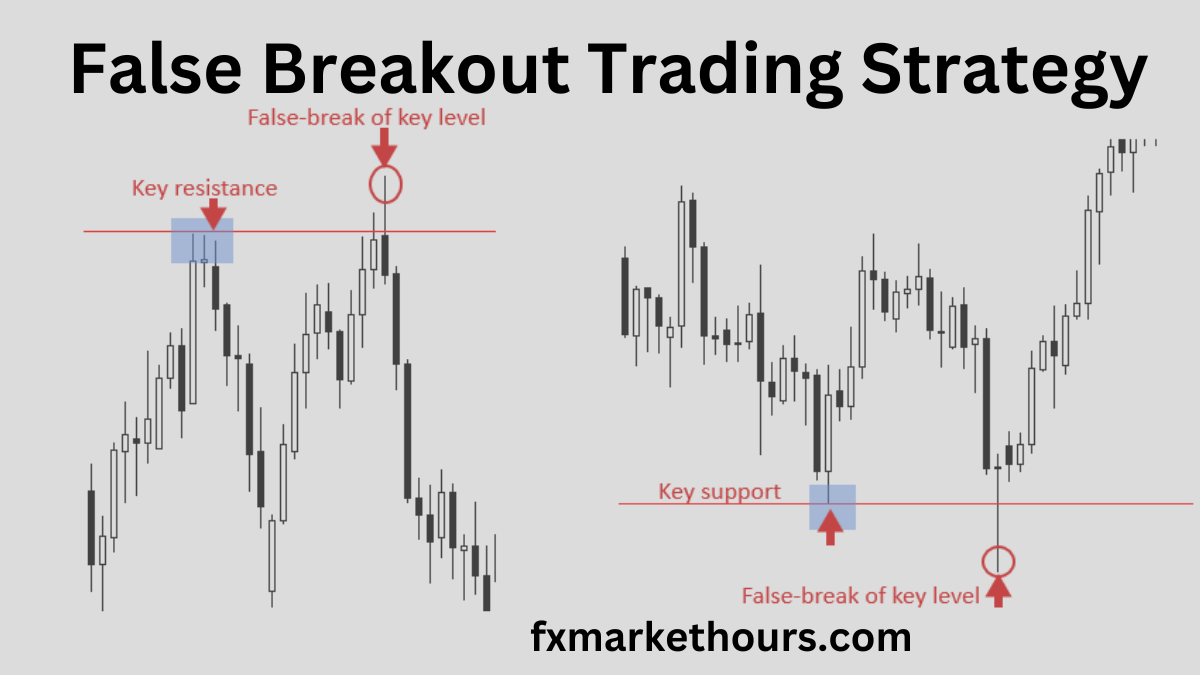

A false breakout happens when the price appears to break through a key level (like support or resistance) but then quickly reverses direction. This can trick traders into thinking the price will keep moving in the breakout direction, only to see it go the opposite way.

Why False Breakouts Matter

False breakouts are important because they can signal that the market is about to change direction or continue in the current trend. If you know how to spot them, you can avoid getting tricked and even use them to your advantage.

Common Situations for False Breakouts

- Trading Ranges: False breakouts often occur when prices are moving sideways within a range. Traders might think the price will break out of the range, but it usually reverses back inside.

- Trends: In a strong trend, you might see false breakouts against the trend. For example, in a downtrend, the price might briefly rise above resistance before continuing down.

Why Do False Breakouts Happen?

- Amateur Traders: New or less experienced traders often jump into trades when it feels safe, like when the price is moving in a clear direction. This can cause false breakouts when the price quickly reverses.

- Professional Traders: Experienced traders watch for these mistakes and use them to enter trades at better prices, with lower risk and higher potential rewards.

How to Trade Using the False Breakout Strategy

1. Trade with the Main Trend

If the market is trending, a false breakout in the opposite direction can be a strong signal that the trend will continue. For example, if the market is in a downtrend, a false breakout to the upside might be a good opportunity to sell, expecting the downtrend to resume.

2. Recognize the Signs of a False Breakout

- Pin Bar: A candlestick with a long wick that shows the price was rejected at a certain level.

- Fakey Pattern: A breakout that quickly reverses, trapping traders who enter the breakout.

3. Wait for Confirmation

To avoid getting caught in a false breakout, wait for the price to stay outside a key level for at least a couple of days before entering a trade.

4. Use Tight Stop Losses

Place your stop loss just beyond the level where the false breakout happened. This helps minimize losses if the trade doesn’t go as planned.

5. Set Realistic Profit Targets

Aim for logical price levels, like the next support or resistance, when setting your take-profit orders.

Examples of False Breakouts

- Downtrend Example: In a strong downtrend, the price might temporarily rise above resistance, causing a false breakout. When the price reverses, it’s a signal that the downtrend is likely to continue, presenting a good short-selling opportunity.

- Range-Bound Market Example: When the market is moving sideways within a range, a false breakout above resistance or below support can be a signal to trade in the opposite direction, aiming for the other side of the range.

Conclusion

The False Breakout Trading Strategy helps you avoid common traps and take advantage of market movements that deceive other traders. By learning the rules and recognizing false breakouts, you can improve your trading decisions and increase your chances of success.

This guide provides a simple introduction to false breakout trading. For a more detailed explanation, consider looking for a False Breakout Trading Strategy PDF that dives deeper into the rules and examples.