Support and Resistance Levels Trading Strategy

Support and resistance levels are essential tools in trading. They represent key price points on a chart where a market reverses or pauses. Understanding and using these levels can greatly improve your trading decisions.

What are the Support and Resistance Levels?

- Support is a price level where a falling market tends to stop because there is enough buying interest to prevent the price from dropping. If the price does fall below this level, it could signal a further drop.

- Resistance is the opposite; it’s a level where a rising market tends to stop, as selling interest increases. If the price rises above this level, it could signal further gains.

How to Identify Support and Resistance Levels

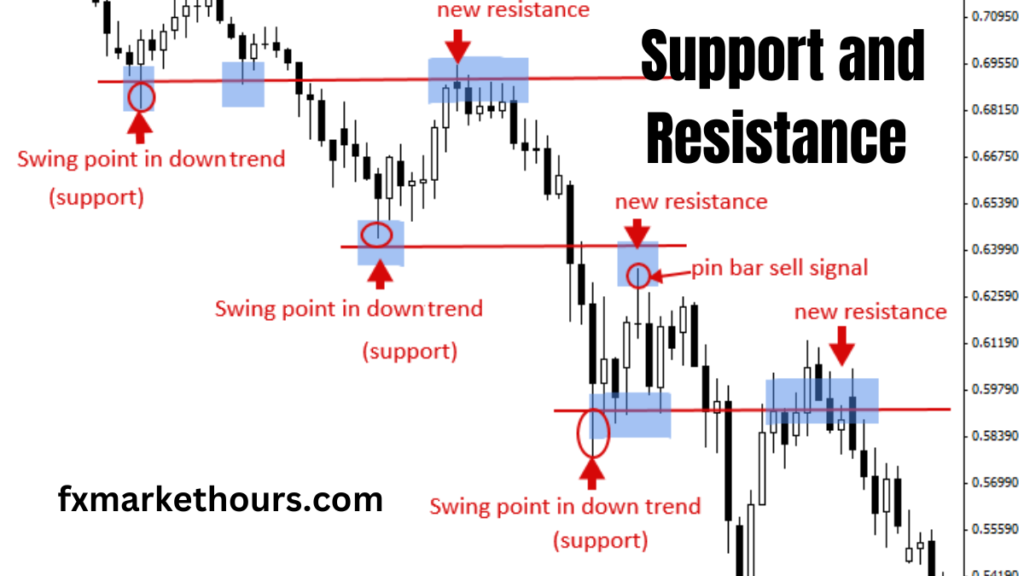

Support and resistance levels are identified by looking for areas on the chart where the price has previously reversed or paused. These levels often form when the price hits a peak or a trough (a swing point) and then changes direction.

Support and Resistance Levels Trading Strategy Rules

- Trading Ranges:

- When the price moves between a clear support level at the bottom and a resistance level at the top, it forms a trading range. Traders often buy near the support level and sell near the resistance level within this range.

- Swing Points in Trends:

- In a trending market, the price retraces and creates swing points. In an uptrend, old resistance levels can become new support. In a downtrend, old support levels can become new resistance.

- Role Reversal:

- After a support level is broken, it can become a new resistance level, and after a resistance level is broken, it can become new support. This switch provides important signals for potential trading opportunities.

Trading Strategy Using Support and Resistance Levels

- Price Action Signals:

- Traders look for signals like pin bars or fake-outs at key support or resistance levels. These signals help confirm that the level will hold, providing a potential entry point.

- Breakout Strategy:

- When the price breaks through a support or resistance level, traders may enter a trade in the direction of the breakout, expecting the price to continue moving in that direction.

- Retest Strategy:

- After a breakout, the price often returns to test the broken level. If the level holds as new support or resistance, this is a good time to enter a trade in the direction of the breakout.

Tips for Using Support and Resistance Levels in Trading

- Please focus on the most important levels, especially those visible on the daily chart, as they tend to be more reliable.

- Don’t worry about drawing perfect lines; the general area is what matters.

- Combine support and resistance levels with other strategies to increase the chances of a successful trade.

- If a trading signal doesn’t form at a key support or resistance level, it might be best to avoid that trade.

By understanding these simple rules and strategies, traders can use support and resistance levels to make better trading decisions. This approach helps in identifying key areas where the market might reverse, offering high-probability trading opportunities.