If you’re struggling with marking lower highs and lower lows in a bearish market, don’t worry! This guide will show you how to identify these patterns clearly. You can also check out my ICT Trading Strategies PDF eBook at fxmarkethours.com for more insights.

Identifying Lower Lows in a Bearish Trend

- Look for Inducement: First, find inducement, where the price temporarily moves against the trend.

- Wait for a Swing Low: After inducement, look for the price to form a swing low. Then, watch for the price to retrace and sweep the inducement.

- Mark the Valid Lower Low: The last swing low before the inducement sweep is the valid lower low. When the price breaks below this low, it’s called a valid break of structure.

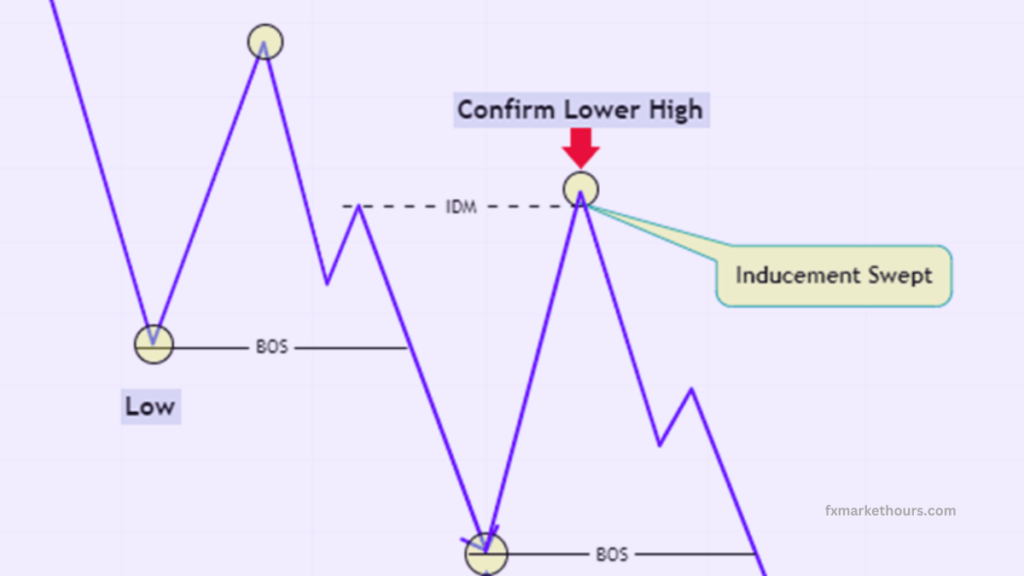

Identifying Lower Highs in a Bearish Trend

- Confirm the Lower Low: After identifying the lower low, wait for the formation of a swing high.

- Check for a Break of Previous Low: If the price moves down and breaks the previous low, the swing high formed at the inducement sweep is the valid lower high.

- Look for Inducement Sweep: Every time the price breaks structure downwards, ensure there’s an inducement sweep to confirm the lower high.

Identifying Structural High After a Bearish CHOCH

- Find the Last Higher High: Mark the last higher high made before the CHOCH (Change of Character). This high marks the start of the bearish trend.

Identifying Structural Low After a Bearish CHOCH

- Look for Inducement and Swing Low: After the bearish CHOCH, find the inducement and wait for a swing low. The last swing low after the inducement sweep is the valid structural low.

Key Points to Remember

- Inducement Sweep is Essential: You need an inducement sweep to confirm a lower low. Without it, the break of structure is minor and doesn’t change the overall market trend.

- Reliability of Market Structure: Learning market structure well and marking it accurately is crucial for effective trading.

For a detailed guide on these strategies, visit fxmarkethours.com.