In this blog post, we’ll explain the ICT HRLR & LRLR – High & Low Resistance Liquidity Run concept and how you can use it in trading. We’ll also include examples to make it easy to understand.

If you’re interested, you can check out my ICT Trading Strategies PDF eBook at fxmarkethours.com.

What is Liquidity in Trading?

Liquidity means how easily you can buy or sell an asset at the current market price without changing that price much. In trading, liquidity is important because it shows where buy and sell orders are likely to be. Prices tend to move toward areas with a lot of liquidity, like old highs with buy orders above them or old lows with sell orders below them.

(I) What is ICT HRLR – High Resistance Liquidity Run?

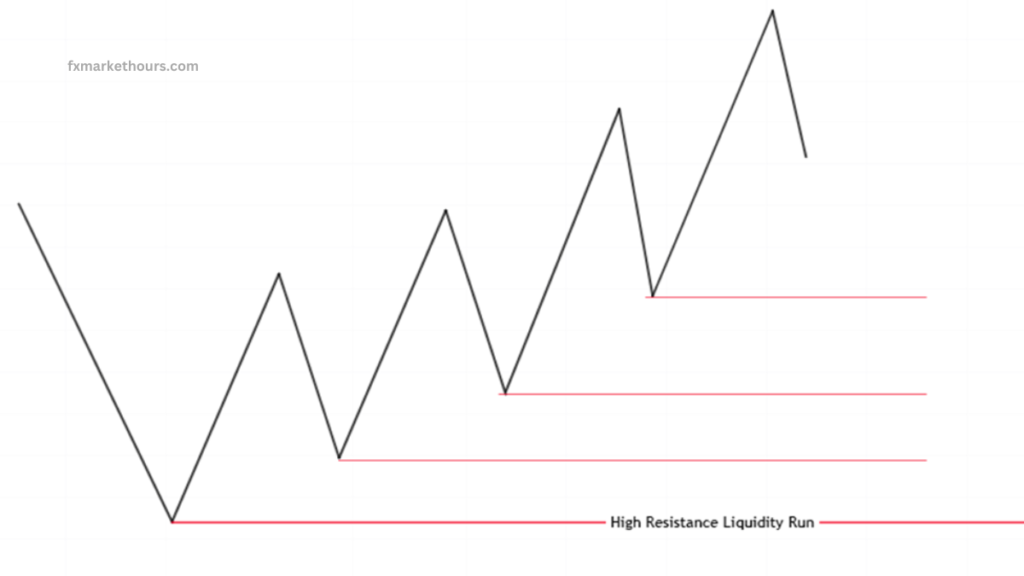

In trading, ICT HRLR – High Resistance Liquidity Run occurs when the price struggles to reach an old high or low because there are multiple smaller highs or lows blocking the way. This is called high resistance liquidity.

For example, if the price is moving up, it might have a hard time dropping below a long-term low because there are many resistance levels in the way. To break through these levels, it might take important news events like NFP, FOMC, or CPI.

ICT HRLR – High Resistance Liquidity Run is generally harder to trade because it’s difficult to reach the target liquidity levels.

(II) What is ICT LRLR – Low Resistance Liquidity Run?

ICT LRLR – Low Resistance Liquidity Run happens when the price moves quickly and easily through areas with less resistance. These areas are called low resistance liquidity because they have fewer obstacles.

In a downtrend, it’s easier for the price to drop below a recent low because there is less resistance. In an uptrend, the price can easily move above a recent high for the same reason.

How to Use ICT HRLR & LRLR – High & Low Resistance Liquidity Run in Trading

You can use the ICT HRLR & LRLR – High & Low Resistance Liquidity Run concept to set your profit targets. Low resistance liquidity runs (LRLR) are easier and faster to trade, making them ideal for most traders. These trades are simpler because the price doesn’t face many obstacles.

If you decide to target high resistance liquidity areas (HRLR), like an old high or low, it may take more time and require a major event like NFP or FOMC to hit your target.

Also, pay attention to institutional order flow. If the flow is bullish, every swing high can be seen as an LRLR, and the long-term low as an HRLR. In a bearish flow, every swing low is an LRLR, and the long-term high is an HRLR.

Feel free to ask questions or share your thoughts in the comments.